WINGS Volunteer Provides Empowering Money Management Classes

- Posted by Sarah Swiston

- On May 8, 2019

- Budget Tips, Budgeting, Domestic Violence, empowerment, End Domestic Violence, Finances, Money Management, money management classes, money tips, non-profit, Volunteer

Tracey Gasparian first learned about WINGS 15 years ago. One of her bank colleagues invited her to assist at a money management class she was teaching to the agency’s domestic violence survivors. Tracey found it so rewarding, that she kept coming back and eventually took over teaching the course. Now she teaches a four-week money management class twice a year to provide empowerment to WINGS housing participants.

Financial stability is often a reason a survivor will stay with or return to an abuser. WINGS works to provide survivors with support, tools, and secure housing so that they can create feel empowered to create an independent life. Family Advocates at WINGS utilize the Allstate Foundation’s financial literacy curriculum in one-on-one meetings with clients. Tracey’s money management course is a crucial supplemental resource for WINGS housing client’s future safety and well-being.

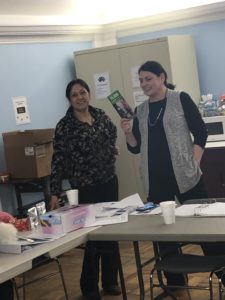

Tracey Gasparian (right) with colleague, Jyoti Adhikary who assisted with classes for the most recent session.

Tracey’s money management course is modified from an 8-week, FDIC bank program to fit the needs of the WINGS clients. To condense the program, Tracey worked closely with WINGS staff to focus on what financial challenges program participants were having and not duplicate information WINGS Family Advocates were already working on with their clients.

Interactive Course Topics

Tracey ensures the course is interactive, engaging participants with direct questions and worksheets about how they budget and use their money.

Tracey ensures the course is interactive, engaging participants with direct questions and worksheets about how they budget and use their money.

The course covers a variety of important concepts including:

- checking accounts,

- budgeting,

- saving,

- paying yourself first,

- evaluating “wants” vs. “needs,”

- credit scores,

- lending,

- how to fix credit, and

- first-time homeowner incentives.

“I came to the United States with $6”

Tracey builds rapport with attendees by sharing her personal story.

“When the first class starts, they come in looking so defeated and I recognize that expression because I’ve been there. I have come from the same background.

As a domestic violence survivor myself, when I first came to the United States from Brazil I had my four children and $6.”

Tracey didn’t have work experience, computer skills, or a college degree. New to the country and community, she didn’t know where to turn for resources or have any furniture.

“I would go to where garage sales had been in Barrington on Sundays to pick over free furniture that didn’t sell. I would go door to door asking for help. Someone let me stay rent free in a house while I worked on finding employment. I really believe I was able to succeed because good people helped me,” Tracey shares.

Luckily, Tracey’s first job paid for her to get a college degree. “Despite all the challenges I’ve faced, today I am a VP of a Bank.

I want the women in my classes to know that there is a way out. I tell them, ‘You have to get empowered. You will succeed. You deserve better and your children deserve better,’” Tracey says.

A Rewarding Investment

Tracey’s experience has been a rewarding investment of her time. “After the last session, women will come up to me hugging, thanking, and sometimes crying because the course has given them so much information and hope. It makes me so happy to help,” Tracey smiles.

Tracey recalls a particular participant, “This one sweet younger woman kept in contact with me. She updated me when she got a credit card, then again when she bought a car, and a few years later let me know she purchased a house. I was so happy for her and it just showed how important the classes were to her.”

Tracey’s Tips:

- Shop around for banks. Find one that will not charge you fees. In class I will ask, ‘How many of you are charged a monthly bank fee?’ and many hands will go up. On the white board I will show them the math, $15 a month for $12 months comes to $180 a year.

We will talk about how making small changes can add up to large savings that can allow you to make life-changing purposes, like a down payment on a house.

- Constantly evaluate purchases as “Wants” vs. “Needs”. It is easy and natural to fall into thinking that “I deserve this, I’ve had a rough time and I’ve been working hard,” but in the long run, that money could be put to use for achieving long-term goals like buying a car or home.

- Everything is negotiable. I’ve negotiated at Bed, Bath and Beyond when a package was broken to get a discount and used a coupon.

- Apply for jobs even if you don’t meet all the criteria. If the posting said to have a college degree and I didn’t have one, I would apply anyway.

- Use your special talent as a supplemental source of income. For example, if you are good at doing people’s hair, do it on the weekend and accept cash payments.

- Shop, but don’t spend. Sometimes I will pick up a nice name brand bag at TJ Max and walk around the store with it. I will let other women notice it and put other things I would “want” to buy in my cart. After a while, I will go and put everything back, including the bag. That satisfies my desire to shop, but not actually spend.

0 Comments